In Northern Ireland, preparing for the future by setting up a Power of Attorney is not just advisable—it’s essential. Life can be unpredictable, and the ability to manage one’s affairs can be compromised at any time due to illness, injury, or the natural ageing process. One of the most critical legal safeguards you can put in place is a Power of Attorney (PoA). This legal tool allows someone you trust to decide on your behalf if you cannot do so yourself, providing you with a sense of security and peace of mind.

In this post, we’ll explore why having a Power of Attorney is crucial and compare it to the alternative route of a Controllership Order. We’ll also highlight the advantages of obtaining the right advice to help you make the right decision for your circumstances.

What is a Power of Attorney?

An Enduring Power of Attorney EPA) is a legal document that grants an individual, known as the Attorney, the authority to make decisions on behalf of the person granting the power, called the Donor. This arrangement can cover a variety of scenarios, such as managing financial matters, depending on the type of EPA you establish.

An Enduring Power of Attorney (EPA) continues even after the Donor has lost mental capacity. It’s a vital safeguard for those who want to ensure their affairs are handled by someone they trust should they become unable to make decisions themselves.

At JJ Taylor & Co Solicitors, we specialize in helping individuals establish an Enduring Power of Attorney. This legal tool offers long-term protection and peace of mind, and our team is dedicated to guiding you through the process with professionalism and care.

Why Is Having a Power of Attorney So Important?

There are several reasons why setting up a Power of Attorney should be a priority:

1. Protection in the Event of Mental Incapacity

Without a Power of Attorney, the consequences of mental incapacity can be severe. Conditions like dementia, stroke, or severe injury can make managing your financial and personal affairs a complex and challenging task. In Northern Ireland, the absence of an EPA means your loved ones must apply to the court for a Controllership Order—a process that is not only costly but also time-consuming, as we’ll explore later.

2. Avoiding Family Conflict

If you don’t appoint an Attorney, family members may end up disputing who should take control of your affairs. A Power of Attorney reduces the risk of family conflict by clearly stating who you trust to make decisions on your behalf, bringing a sense of certainty to your loved ones.

3. Ensuring Your Wishes Are Respected

By appointing an Attorney, you retain control over who will manage your affairs. You can stipulate how you want your money, property, and personal care handled, ensuring your wishes are respected even if you can’t express them yourself. This sense of control and empowerment is a key benefit of having a Power of Attorney.

4. Efficient Management of Financial Affairs

When you appoint an Attorney, your Attorney can access your finances immediately (unless you restrict it). This ensures that your bills are paid on time, your investments are managed, and your financial interests are protected without court intervention.

5. Flexibility and Customisation

An EPA can be tailored to your specific needs and preferences. You can specify the scope of the Attorney’s powers, limiting or expanding their authority as you see fit. This flexibility allows you to design the best solution for you and your family.

Controllership Orders: The Alternative to a Power of Attorney

Suppose a person becomes mentally incapable without an Enduring Power of Attorney. In that case, their loved ones must apply for a Controllership Order through the Office of Care and Protection. This process grants someone the authority to manage the incapacitated person’s financial affairs. While a Controllership Order provides a solution when no EPA exists, it has several drawbacks.

The Drawbacks of a Controllership Order

1. Court Intervention and Oversight

Unlike a Power of Attorney, a Controllership Order requires ongoing court oversight. The Office of Care and Protection must approve decisions made by the Controller, which can lead to delays in critical financial transactions. Regular reports to the court are mandatory, creating additional administrative work for the Controller.

2. Expense

Obtaining a Controllership Order is significantly more expensive than setting up a Power of Attorney. The application process involves greater legal fees, initial court costs, and there will be additional costs for ongoing court supervision. At JJ Taylor & Co Solicitors, we’ve seen how these expenses can add up quickly, placing an unnecessary financial burden on families already dealing with a loved one’s incapacity.

3. Time-Consuming Process

The application for a Controllership Order can take months to process. During this time, the person’s financial affairs may be in limbo, with no one able to access their bank accounts, manage their investments, or settle outstanding bills. This delay can have serious consequences, especially if urgent financial decisions are needed.

4. Lack of Personal Choice

Without an Enduring Power of Attorney, the court decides who will act as Controller. This person may not be the person the incapacitated individual would have chosen, leading to dissatisfaction or family disputes.

5. Reduced Autonomy

A Controllership Order places a great deal of decision-making power in the hands of the court. While this is necessary to protect vulnerable individuals, it limits the flexibility and autonomy that an EPA offers. The Controller is restricted by the court’s rules, which can be more rigid than the tailored instructions set out in an EPA.

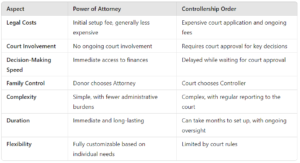

Power of Attorney vs. Controllership Order: A Direct Comparison

As the table illustrates, the Power of Attorney provides far more cost, control, and efficiency benefits. Establishing an EPA allows individuals and their families to avoid the long, expensive, and stressful process of applying for a Controllership Order.

How JJ Taylor & Co Solicitors Can Help You

At JJ Taylor & Co Solicitors, we understand that making decisions about your future legal affairs can be daunting. That’s why we offer compassionate, professional, and comprehensive services to help you establish a Power of Attorney that fits your unique needs. Here’s how we can assist:

1. Expert Legal Advice

Our team of experienced solicitors will provide clear, concise legal advice, ensuring you fully understand the process and implications of setting up a Power of Attorney. We’ll help you make informed decisions about the type of EPA that best suits your situation.

2. Tailored Solutions

Clients are unique, and their Power of Attorney should reflect their circumstances. We’ll work with you to customize your EPA, specifying who will act as your Attorney and outlining the extent of their powers.

3. Efficient and Hassle-Free Process

We take the stress out of setting up a Power of Attorney. From drafting the document to registering it with the court, we’ll handle every step of the process, ensuring that your EPA is legally binding and ready for use when needed.

4. Preventing Future Legal Complications

By establishing a Power of Attorney with us, you’re protecting yourself and your loved ones from the complexities and costs of Controllership Orders. Our proactive approach ensures that your affairs are in order, giving you and your family peace of mind.

5. Ongoing Support

Our relationship with our clients doesn’t end once the EPAis in place. We’re here to provide ongoing support and advice as needed, ensuring that your Power of Attorney remains practical and current with any changes in your circumstances or the law.

Conclusion: Securing Your Future with a Power of Attorney

In Northern Ireland, preparing for the possibility of mental incapacity is a vital part of protecting yourself and your family. A Power of Attorney offers a simple, cost-effective, and flexible way to ensure that your affairs are managed according to your wishes, even if you can no longer make decisions for yourself.

The alternative, a Controllership Order, is far more costly, time-consuming, and restrictive, placing significant control in the hands of the courts. At JJ Taylor & Co Solicitors, we help you avoid these pitfalls by setting up a Power of Attorney that works for you.

Don’t leave your future to chance. Contact JJ Taylor & Co Solicitors today to discuss how we can assist you in making the right legal decisions for your future and safeguarding your interests. With our expert guidance, you can have peace of mind knowing that your affairs will be managed with care and professionalism.