As we approach the UK government’s Autumn Budget 2024, there’s growing speculation about potential changes to Capital Gains Tax (CGT). With the government seeking to balance its books, increasing CGT rates could be on the horizon (as well as inheritance tax changes, but that speculation is for another day). This post will reveal the potential changes and their implications for investors and property owners.

As we approach the UK government’s Autumn Budget 2024, there’s growing speculation about potential changes to Capital Gains Tax (CGT). With the government seeking to balance its books, increasing CGT rates could be on the horizon (as well as inheritance tax changes, but that speculation is for another day). This post will reveal the potential changes and their implications for investors and property owners.

Likely Scenario: Higher CGT Rates

Based on current indicators, the most likely scenario is an increase in CGT rates. We’ve seen speculation a basic rate increase to 18% and a higher rate rise to 28%. These changes would align CGT more closely with income tax rates, potentially bringing in additional revenue for the government.

Tax-Free Allowance: Expected to Remain Unchanged

It’s crucial to note that the tax-free allowance for CGT is expected to remain unchanged. This means: – Gains up to £3,000 would still be exempt from CGT – Any gains above this threshold would be subject to the new, higher rates. However, it’s important to remember that these are predictions based on current information, and the final details may differ.

Timing is Key

We anticipate these changes will take effect immediately from the Budget announcement in October 2024. This immediate implementation would prevent a rush to sell assets at lower rates.

Implications for Investors and Property Owners

For investors, property owners, and anyone holding significant assets, reviewing your portfolio and tax strategies is critical. The potential for an immediate change could significantly impact your tax liabilities. Consider the following actions:

1. Review your current asset portfolio

2. Assess potential gains on your investments

3. Consult with a tax professional to explore your options

4. Consider the timing of any planned asset sales

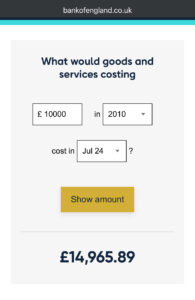

CGT and Inflation

Since 1998 capital gains calculations don’t account for the inflation in an economy. The common justification being the lower rates of CGT (compared to income tax) offset any inflation. As can be seen, an asset worth £10,000 in 2010 is now worth nearly 50% more (despite no actual gain in purchasing power accruing). This is obviously simplified given that all assets experience their own inflation. Despite this, the “gain” will be subject to CGT as it exceeds the £3,000 limit. With the likely raising of rates, inflation will lead to more fiscal drag similar to what we currently see in income tax. Ultimately, it will be on individuals to store capital in an asset which will outgain inflation, plus any CGT on disposal.

Looking Ahead

While nothing is certain until the Chancellor’s statement, the signs are pointing towards a CGT increase as a likely tool for the government to address fiscal challenges. At J J Taylor & Co, we’re committed to keeping our clients informed and prepared for potential changes in tax law. We encourage you to stay informed and be prepared for what’s next. If you have any questions about how these changes might affect your financial planning, please don’t hesitate to contact our team of solicitors.

*Disclaimer: This blog post is based on current speculation and analysis. The final details of any tax changes will only be confirmed in the official Autumn Budget announcement.*